Investment

Planning

Our focus in designing investment planning strategies for our clients is to earn a competitive after-tax rate of return, while managing risks consistent with our client’s goals. Risk management is important to us. It is the reason we rebalance client’s portfolios based on market valuations, determine cash flow needs so as to mitigate liquidity risk and utilize components of modern portfolio theory to reduce market risk within a portfolio.

Portfolio construction occurs by blending our macro strategic outlook with the goals specified by the client. We firmly believe in open architecture and utilize a number of investment planning vehicles including Exchange Traded Funds (ETFs), individual securities (stocks and bonds), closed-end & open-end funds and Master Limited Partnerships (MLPs). We avoid investments that are illiquid or opaque, and as such, do not invest in hedge funds, direct real estate investments or private equity investments.

Risk management is important to us.

Risk management is important to us.

Financial

Planning

At the core of our service is individualized financial planning. Our thorough analysis of a client’s resources, circumstances, needs and goals is the basis for customized financial planning. Your personalized plan will be designed to address the goals and concerns most important to you, such as building towards a comfortable retirement, providing for your children’s or grandchildren’s education, planning your legacy through a carefully designed estate, maximizing tax advantages and selecting appropriate insurance policies.

Your plan is how we connect your money to your aspirations.

Legacy

Planning

Estate planning is much more than drafting a will…How do you want to be remembered? Our Avoiding the Family Fight planning process is designed for those individuals that hope to leave an amiable family unit behind when they pass.

Your legacy begins with a plan.

Our "What If"

Advantage

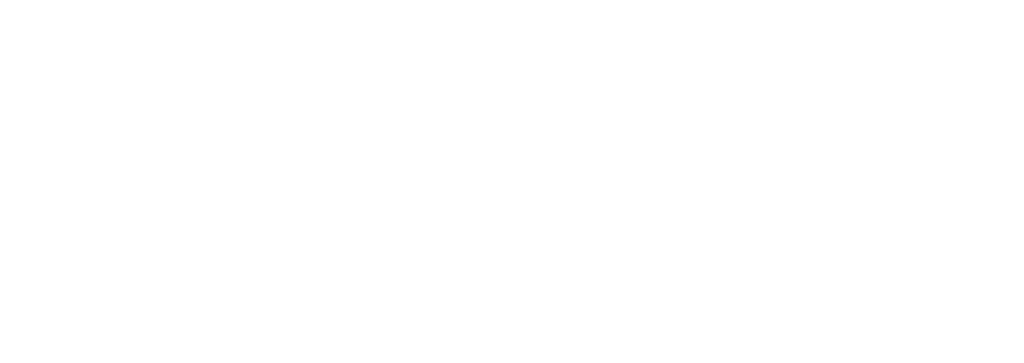

When creating an investment or comprehensive financial plan for a client, most advisors present one to two scenarios for final review. These plans almost always use a linear, or an “average”, investment rate of return when calculating portfolio values. The problem with this approach is investors never earn “average” rates of return! They earn yearly returns which can be averaged at the end of their retirement period. Our approach takes into account the reality of experiencing returns above and below the “average” return. Our approach adds a level of risk to account for the sequence of returns a client could experience. The difference is subtle but the calculation method an advisor uses can dramatically understate the risk of running out of money during retirement.

For example, Client A retires with a $500,000 investment account, plans on withdrawing $25,000 every year and maintains a portfolio allocation that historically delivered 5% returns.

All scenarios in the above example maintain an “average” return of 5%, but each scenario results in different ending portfolio values. The last three scenarios reflect the reality of earning above and below the “average” return and the resulting impact to asset values. If stretched over a typical retirement period of 20-30 years, the differences between approaches can be substantial.

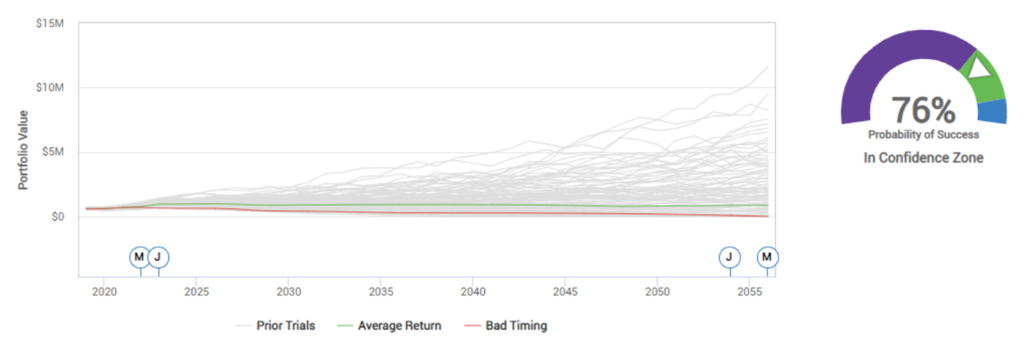

The graph below shows actual results from our financial modeling software and approach.

Over a thousand scenarios were run and ending asset levels recorded for each scenario. You can see how asset values can vary wildly from the “average.” To the right of the graph, we capture the percentage of scenarios (76% in this example) where the client did NOT run out of money. Having to go back to work during the retirement period would be considered a failure for most clients. Wouldn’t you want to know the likelihood of such a scenario? Wouldn’t you want to know “what if” returns aren’t “average?”

Our firm takes investment and financial planning seriously because our clients financial well-being demands it. Contact us to learn more about how our planning process stands out.

“

What you leave behind is not what is engraved in stone monuments, but what is woven into the lives of others.

– Pericles